So, You’re Not Going Back to Work as Long as I Keep Paying You?

By: Jordan Goldring | Atlanta, GA

Editors: Nina Szymaszek | Atlanta, GA

Editors: Karysa Eraclides | Sarasota, FL

One of the most frustrating things in the Georgia workers’ compensation system is the inability to suspend a claimant’s indemnity benefits. Once a claimant has learned to survive off TTD or TPD benefits, it can seem near impossible to get them back to work to suspend those benefits. Unfortunately, the Georgia workers’ compensation system is designed to benefit the injured worker and leaves few remedies available to employers and insurers and who are dealing with an injured worker who has no desire to ever return to work. In other words, without a full duty release, the claimant voluntarily returning to work with restrictions (yeah right!), or having paid out the maximum TPD or PPD amount, employers and insurers often find themselves paying ongoing benefits with no light at the end of the tunnel. However, your arsenal is not empty. There are still a few secret weapons that employers and insurers can use to suspend benefits and move a stubborn claim(ant) towards resolution.

- The WC-240 Return to Work Process

Board Rule 240 and O.C.G.A. § 34-9-240 allow employers to return injured workers to suitable light duty employment. The benefit of the WC-240 process to employers and insurers is that it gets claimants off the couch and requires them to actually do something – i.e. working hard for their money.

Once the Authorized Treating Physician has released an employee to light duty work, and the employer has confirmed it can accommodate those restrictions, the employer can obtain an approved light duty job analysis from the authorized treating physician (“ATP”). If the ATP approves the light duty position, the employer can submit a WC-240 Notice to Employee of Offer of Suitable Employment to the employee. This notice must provide the employee with 10 calendar days’ notice of the return-to-work date.

If the employee reports to work on the date and time noted on the WC-240, benefits can be unilaterally suspended immediately. However, if the employee attempts to do the light duty job for at least 8 hours, but for less than 15 days, the Board Rules and statutes require that income benefits be immediately recommenced. The statute requires that the employee have actually worked (clocked in and out) for 15 days in order to uphold the prior suspension of benefits.

For a more detailed explanation of the WC-240 process, check out my prior article: The WC-240 Process: Returning An Injured Employee to Work in the “Return to Work State” at this link: https://eraclides.com/eg-gazette-february-2023/.

- The WC-PMTb Show Cause Petition

The Act requires all injured workers to comply with authorized medical treatment. O.C.G.A. § 34-9-202(c) says that “as long as an employee is receiving compensation, he or she shall submit himself or herself to examination by the authorized treating physician at reasonable times. If the employee refuses to submit himself or herself to or in any way obstructs such an examination requested by and provided for by the employer, upon order of the board his or her right to compensation shall be suspended until such refusal or objection ceases.” However, for a variety of reasons, injured workers become non-compliant with authorized medical treatment. The Employer/Insurer can always file a Motion to suspend benefits on these grounds; however, the claimant has 15 days to object, and then the Judge has time to review the briefs and exhibits before issuing an Order. This process can take months and often does not produce the results employers and insurers are hoping for.

Fortunately, the WC-PMTb provides the Employer/Insurer with some more immediate recourse in this situation. The WC-PMTb, Show Cause Petition, allows Employer/Insurers to request a teleconference with the Judge to require the claimant to “show cause whether an order should issue directing the Employee to attend the medical appointment with the physician.”

If an injured worker was scheduled to attend an appointment with an authorized treating physician and was given advance notice of the appointment but failed to attend, the Employer/Insurer may file a WC-PMTb with the Board. When filing this form, you are required to attach proof of and list the date that notice of the appointment was given. Accordingly, it is important to ensure that you are always sending notice of the appointment via email to the claimant’s attorney and/or in a written letter mailed to the claimant. (We recommend doing both just to be safe). Once a WC-PMTb is filed, a telephone conference will be scheduled with the Judge. The claimant can then file an “Agreement” with the Board stating that they will attend the rescheduled appointment, or can participate in the phone conference and explain to the Judge why he or she failed to attend the appointment (i.e., explain why their failure to comply with authorized medical treatment was “justified.”)

If the Judge does not find that the claimant has unjustifiably refused to comply with medical treatment, then the Employer/Insurer will need to schedule another appointment and send notice to the claimant. The process restarts. However, if the claimant misses a second appointment and another WC-PMTb is filed, the Judge should (hopefully) start to see a pattern and rule in favor of the Employer/Insurer the second time.

Alternatively, if the claimant files an “Agreement” or the Judge issues an Order directing the claimant to attend the rescheduled appointment, the outcome for missing the rescheduled appointment is different than above. The Employer/Insurer can then file a PMTb Suspend Benefits Petition. Another teleconference with the Judge will be scheduled at which time the claimant will be required to show cause why the employee’s disability benefits should not be suspended. Absent some justified reason for failing to attend the rescheduled appointment, the Judge can issue an Order authorizing the Employer/Insurer to unilaterally suspend the claimant’s benefits (these Orders often include language such as “for as long as the Employee fails to submit to a medical appointment with an authorized physician.”)

- The Maloney Standard

While the aforementioned processes typically deal with suspending benefits, the Maloney standard deserves its fifteen minutes of fame. Maloney comes into play when an injured worker is terminated for reasons unrelated to his or her at-work accident. As I am sure you are aware, claimants’ attorneys will demand that benefits commence as soon as their client is terminated. Fortunately for employers and insurers, the law does not always require that.

In Maloney v. Gordon County Farms, the Georgia Supreme Court declared that in order for a claimant to receive benefits based upon a change in condition, the claimant must establish by preponderance of evidence that “she suffered a loss of earning power as a result of a compensable work-related injury; continues to suffer physical limitations attributable to that injury; and has made a diligent, but unsuccessful effort to secure suitable employment following termination. 265 Ga. 825, 828 (1995).

The first step in determining whether Maloney applies to your claim is verifying with the employer the reasons for the claimant’s termination. If the claimant was terminated because they could not perform their job duties because of their injury (which claimants will always argue is the case), or because of attendance issues related to the injury, Maloney likely will not apply, and you may need to commence benefits. However, if the claimant was already having disciplinary issues, attendance issues, or other causes for concern, we recommend obtaining any written warnings that were given to the claimant, documentation of any verbal warnings (and an employer representative who can testify regrading same), and the separation notice, as these documents will likely need to be tendered into evidence at a hearing to support your Maloney argument.

It is not entirely clear what constitutes a “diligent, but unsuccessful effort to secure suitable employment,” but the Georgia courts have offered some guidance. For example, in Brown Mech. Contrs., Inc. v. Maughon, the Georgia Court of Appeals upheld the Board’s determination that 110 job searches over 144 workdays (excluding weekends and holidays) was not sufficient. Further, the Court of Appeals agreed with the Board that averaging less than one search per day, failing to look for work for periods of 11 and 18 business days, and failing to follow-up with 22 potential employers was not a diligent job search.

Moreover, in L. C. P. Chemicals v. Strickland, benefits were similarly denied on the basis that the claimant had not conducted a diligent yet unsuccessful job search. While the claimant had submitted a work search log which detailed his job search, the board found that the claimant had failed to exercise “diligence” in his search for employment. The Georgia Court of Appeals found there was evidence supporting this position, including the fact that the claimant fished frequently, helped his girlfriend manage a trailer park, was a member of two bowling leagues, and ran for county commissioner, raising $10,000 to $12,000 in his effort to do so.

However, in R.R. Donnelley v. Ogletree, the Court of Appeals considered the quality of the claimant’s job search within the parameters expressed by the Court in Maloney and narrowed the scope of Maloney. Following the claimant’s lay off, he began looking for work using the internet, newspaper, and the Georgia Department of Labor’s Web site. The hearing testimony revealed the claimant applied for jobs that were within his physical restrictions, and he testified he submitted approximately 24 job applications. Some of the prospective employers did not respond to his applications, while others responded by e-mail advising him the position had been filled by other applicants. The claimant did not personally visit any potential employers or have interviews. The Court of Appeals reversed the Board’s decision that the claimant’s job search was not diligent. By requiring the claimant to secure interviews and have in-person site visits with prospective employers, the Court believed the Board imposed an additional burden on the claimant beyond what is required under Maloney to show a change in condition. Because the alleged additional burden imposed by the Board related to matters that were beyond the claimant’s control and inconsistent with the instructions he had been given during the hiring process, the court concluded the Board erred by finding the job search was not diligent.

Please note that while Maloney typically applies to termination cases, there is at least one case in which the Court of Appeals applied Maloney to a voluntary resignation case. In Fulton County Bd. of Educ. v. Taylor, the claimant resigned from employment with the Fulton County Board of Education for reasons unrelated to the compensable injury. The Court of Appeals found the claimant only looked for work for one week in May of 2000, and for a few days in June of 2000. Accordingly, he failed to carry his burden of proving a diligent yet unsuccessful job search under the Maloney framework. The Court of Appeals affirmed the Appellate Division’s Award, denying the claimant’s request for temporary total disability benefits.

Additionally, it is important to keep in mind that Maloney ONLY applies when the claimant is on light duty restrictions. If the claimant is terminated while on light duty restrictions and subsequently gets taken out of work by the authorized treating physician, then Maloney no longer applies, and you will likely need to commence indemnity benefits.

We know that us “big bad insurance companies” are always eager to controvert or suspend benefits and move claims towards resolution. If you have any questions or simply want a legal opinion on whether you have enough to deny or suspend benefits in your claim, feel free to give me a call or shoot me an email!

Were They Coming or Going? Compensability of a Motor Vehicle Accident

By: Kayli Marston | West Palm Beach, Florida

Editors: Nina Szymaszek | Atlanta, GA

Editors: Karysa Eraclides | Sarasota, FLYou’ve received a new workers’ compensation claim involving a motor vehicle accident.

Sarah Doe was provided a vehicle to use personally, as well as to get to and from work from Conley-Smith, Inc. (“Conley-Smith”). On April 27, 2022, Sarah and Julian Aggy (passenger and employee) were riding in Doe’s vehicle when the car was hit by semi-truck, which caused serious injury to both. Doe had picked up Aggy from a Home Depot. This is a part of their normal routine as Aggy lives far from the job site, like Doe. They met at Home Depot in order to carpool together. Doe and Aggy were on their way to work when the accident occurred.

The facts, as laid out above, raise the question of whether this claim is compensable or not. To make that determination, our attention should go to the going and coming provision of Florida Statue 440.092.

Florida Statute 440.092(2) is where the going and coming provision is statutorily defined:

An injury suffered while going to or coming from work is not an injury arising out of and in the course of employment whether or not the employer provided transportation if such means of transportation was available for the exclusive personal use by the employee, unless the employee was engaged in special errand or mission for the employer.

Initially we look at when the employee’s work begins and when it ends. The question becomes—when does work begin and when does it end? Not all employees travel to a fixed location to punch a timecard and begin their workday. Workers’ compensation covers injuries that “aris[e] out of work performed in the course and the scope of employment.” § 440.09, Fla. Stat. Generally, for purposes of workers’ compensation, an employee “means any person who receives remuneration from an employer for the performance of any work or services while engaged in any employment.” Kelly Air Sys., LLC v. Kohlun, 337 So. 3d 883, 887 (Fla. 1st DCA 2022). The court further explained that if the employee is engaged in an activity for which the employer is paying them, then the employee is at work.

“Going to and coming from work”, as discussed above, contemplates uncompensated travel that is not otherwise connected with employment. Id. “Work begins when the employee starts to be compensated in the normal course of the workday and excludes uncompensated travel to and from the place where compensation begins.” Id.

If Doe and Aggy were being compensated at the time of the crash, the claims specific to each may be compensable. Compensation can include actual wages or mileage reimbursement as well as per diem. These are important facts to elicit from the employer at the outset of the case, whether the employee is driving an employer provided vehicle or their own vehicle.

It’s also important to ask your employers for information concerning the claimant’s pay, hours worked and if they consider them to be compensated for their drive to and from work.

Now, in the facts above, Doe was provided a vehicle by their employer. F.S. 440.092(2) indicates that if employer provided transportation was available for the “exclusive personal use” of the employee, an injury suffered while going to or coming from is not compensable. The First District Court of Appeals stated that “it is a question of fact whether the employee has exclusive personal use of a vehicle.” Gulbrandsen vv. Carlton Wilbert Vault, Inc., 742 So. 2d 294, 295 (Fla. 1st DCA 1998). An injury is not compensable where the employee’s transportation is available exclusively to that employee and the employee can use the transportation as if it were personal property for the purpose of going to and coming from work. Kelly Air, 337 So. 3d 883, (Fla. 1st DCA 2022).

Here, like in Kelly Air, Doe was free to use the employer provided vehicle at her convenience for travel to and from work. She was similarly free to use the vehicle for personal errands. Doe was not required to share the vehicle, nor was she required to provide transportation to other employees. She transported Aggy to and from work by choice. Doe’s use of the vehicle was also not conditioned on her completing additional tasks for Conley-Smith. The Kelly Air Court further opined that the real question is whether the vehicle is available for the exclusive personal use for travel to and from work. In this case, it was. Therefore, as to Sarah Doe, there is a good faith basis for denial of compensability.

Now, if Doe and Aggy were leaving one job site and heading to another when they were in an accident, that would like likely be compensable considering they were still being compensated. If the travel occurred between compensated employment activities without “significant break or interruption,” then the travel was not going to or coming from work. Florida Hospital v. Garabedian, 765 So. 2d 987, (Fla. 1st DCA 2000).

This a very nuanced and fact specific area of the law. It’s important to get with your attorney regarding your specific case and facts for guidance as quickly as possible, if you’re unsure.

Please reach out with any questions you may have – we are always happy to answer your questions!

When to Pay Temporary Partial Disability Benefits When Claimant is Working Light Duty

By: Meagan Pearson & Marilyn Linares | Jacksonville, FL

Editors: Nina Szymaszek | Atlanta, GA Editors: Karysa Eraclides | Sarasota, FL

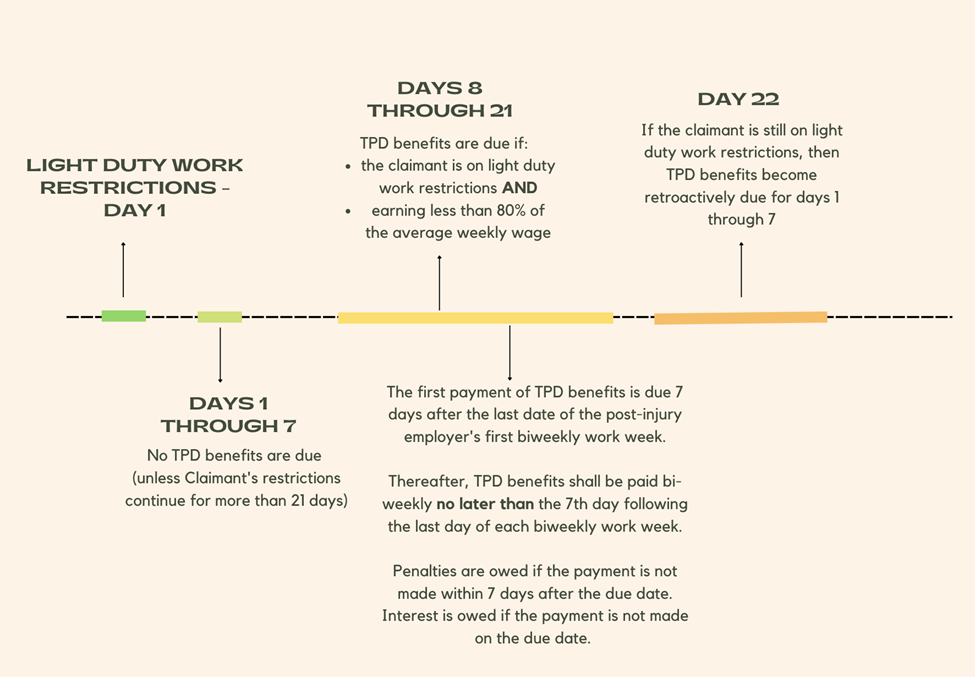

Regardless of the type of disability, Florida law provides that an injured employee will not be paid for the first seven days of missed work after the injury. The carrier will be responsible for payment from calendar day 8 through calendar day 21. Should the injured employee’s inability to return to work continue to calendar day 22 and forward, then the employee will be paid retroactively for calendar days 1 through 7. Therefore, an employee will not receive temporary partial disability benefits for the first seven days of disability, unless they are disabled for more than 21 days due to the work-related injury.

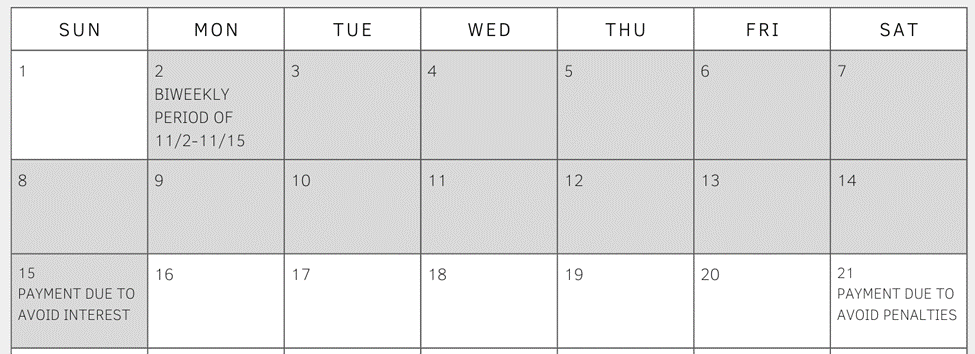

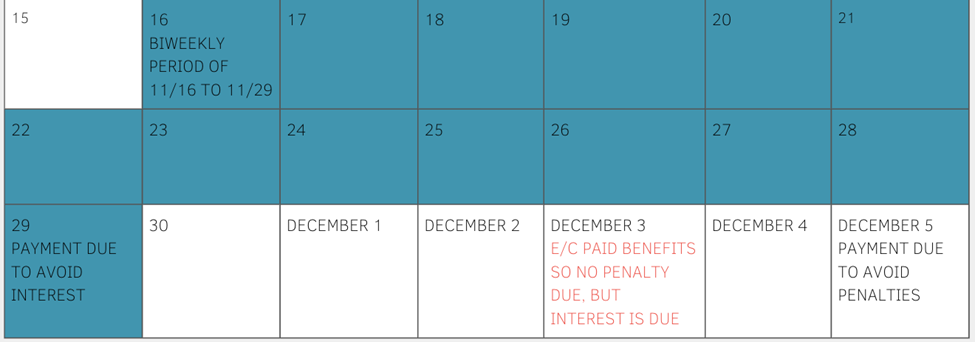

Florida Statute 440.15(4)(c) states that when an employee returns to work with the restrictions resulting from the accident and is earning wages less than 80 percent of the preinjury average weekly wage, the first installment of temporary partial disability benefits is due 7 days after the last date of the postinjury employer’s first biweekly work week. Thereafter, payment for temporary partial benefits shall be paid biweekly no later than the 7th day following the last day of each biweekly work week.

If the employer is able to accommodate claimant’s work restrictions AND the claimant is earning at least 80% of their pre-injury average weekly wage, then the employer/carrier does not have to pay the claimant temporary partial disability benefits. However, if the claimant is earning less than 80% of their pre-injury average weekly wage, then the employer does have to pay the claimant temporary partial disability benefits. The first payment is due seven (7) days AFTER the last date of the employer’s first bi-weekly work week. Florida Admin. Code, Rule 69L-3.002(2) defines “biweekly work week” as two consecutive 7-day periods coinciding with the post-injury employer’s work week. For the purposes of calculating Temporary Partial Benefits pursuant to section 440.15(4), F.S., the first biweekly work week includes the week the employee returned to work.

For example, in the OJCC Case of Alberto Perez v. Americana Village Condominium Associates, etc. Case No.: 18-021806SMS, decided April 6, 2021, the JCC determined that a carrier must pay indemnity benefits within 7 days after it becomes due in order to avoid paying penalties. Penalties are owed if the payment is not made within 7 days after the due date. Interest is owed if the payment is not made on the due date.

In the case at hand, indemnity benefits were due for the biweekly period of November 2, 2020, to November 15, 2020. In order to avoid a penalty, the indemnity benefits were due on November 21, 2020. The E/C paid the benefits on December 3, 2020 (outside the 7 days), and therefore, penalties were due. In order to avoid interest, the indemnity benefits were due on November 15, 2020. Since the E/C paid on December 3, 2020 (13 days late), interest was due.

As to the biweekly period of November 16, 2020, to November 29, 2020, the indemnity benefits would have been due on November 29, 2020. The E/C paid those benefits on December 3, 2020. Since it was paid within 7 days after the due date, no penalties were owed. However, since the payment was made after the due date, interest was owed.

Sample scenario:

Erin, the injured employee, is hurt at work on January 2, 2023. After an evaluation by Dr. Ortho, she is placed on light duty work restrictions. She remains on light duty work restrictions for the entirety of January. TPD benefits do not commence until the eighth day, so TPD is not due until January 10, 2023. Since Erin remains on light duty status after 21 days, TPD benefits are retroactively due for the first seven days on January 23, 2023. If Erin were only on light duty work restrictions until January 20 (18 days), then she would be entitled to TPD benefits from January 10th until January 20th (from the 8th day through the 18th day).